Deposits that are in the Settlement Account while in the process of being swept to or from a partner bank will be subject to FDIC coverage of up to $250,000 per customer (combined with any other customer deposits at the bank holding the Settlement Account). FDIC coverage does not apply to deposits while at the Clearing Bank or any account at an intermediary depositary institution. Only the first $250,000 in combined deposits at any partner bank will be subject to FDIC coverage.

Within two business days, funds are transferred to a disbursement account at a Brex Treasury Third-Party Service Provider (the “Settlement Account”), and then swept automatically into omnibus deposit accounts established by Brex Treasury in its name on behalf of Brex Treasury customers at Brex's designated partner banks. Uninvested Balances in your Brex Cash Account will initially be combined with Uninvested Balances from other Brex Treasury customers and deposited in a single account at LendingClub Bank, N.A. After providing at least 60 days’ prior written notice to shareholders, the fund’s board reserves the right to impose a fee upon the sale of shares or temporarily suspend redemptions if the fund’s liquidity falls below certain levels. The fund’s sponsor has no legal obligation to provide financial support to the fund and you should not expect that it will do so at any time. An investment in the fund is not insured or guaranteed by the FDIC or any other government agency. The fund cannot guarantee that it will preserve the value of your investment at $1 per share. Past performance is not necessarily indicative of future results. Contact us for a copy of the fund prospectus and recent performance data.

See program disclosures and the applicable fund prospectus before investing for details and other information on the fund. Yield is variable, fluctuates and is inclusive of reduced expense fees, as determined solely by the fund manager. The money market funds offered by Brex Cash are independently managed and are not affiliated with Brex Treasury. You could lose money by investing in a money market mutual fund.

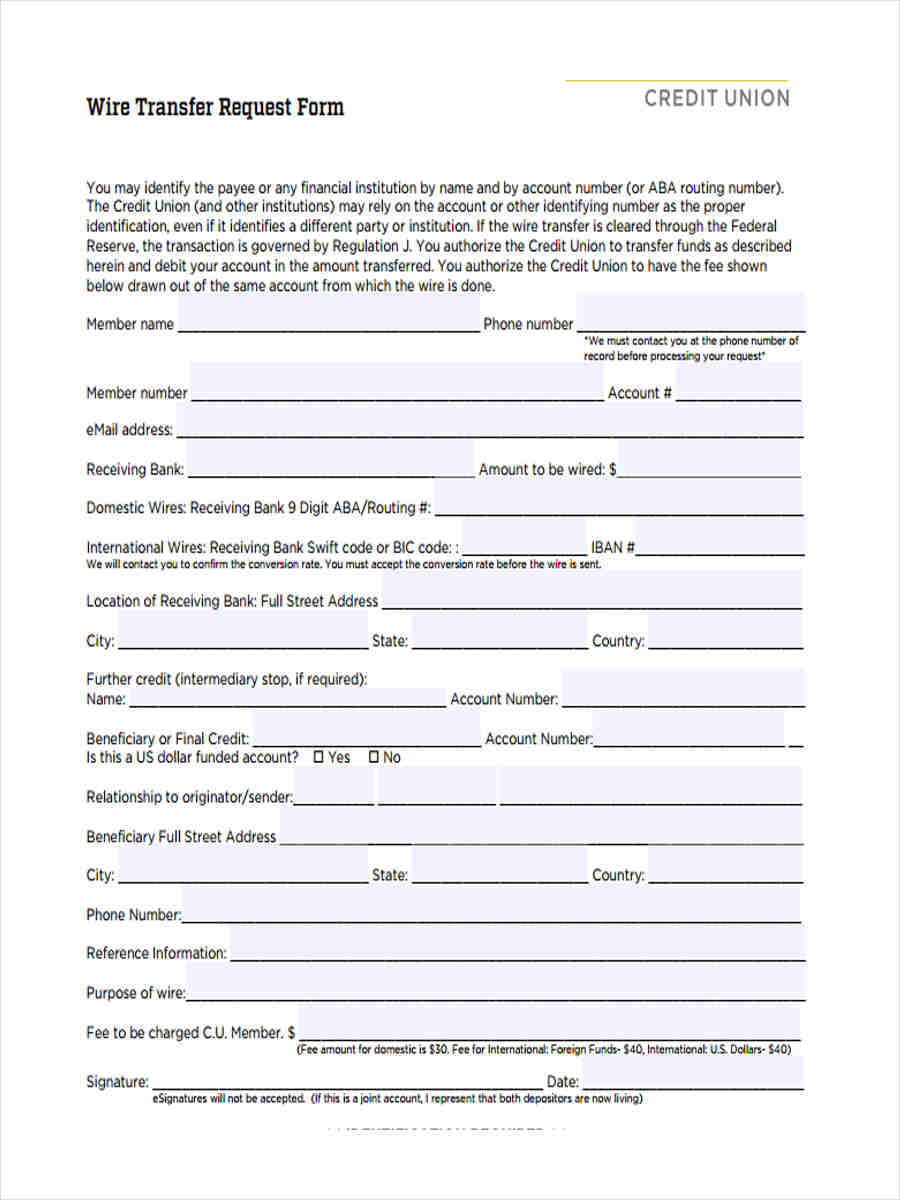

#Domestic incoming wire fee free#

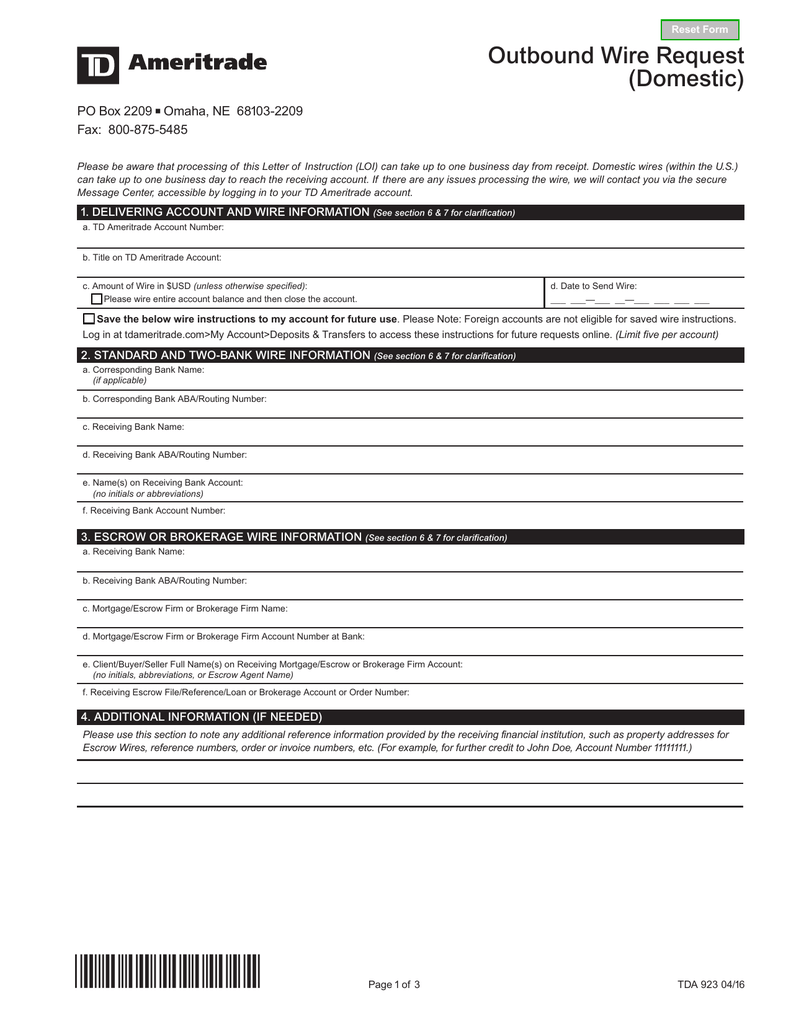

Sending wire transfers is free for Brex Cash customers, but the recipient’s financial institution may charge a wire receipt fee. Although Brex Treasury does not charge transaction or account fees, money market funds bear expenses and fees. Review the background of Brex Treasury or its investment professionals on FINRA's BrokerCheck website. Consider your company’s investment objectives and relevant risks, charges, and expenses before investing. Please visit the Deposit Sweep Program Disclosure Statement for important legal disclosures.īrex Treasury is not an investment adviser. Brex Treasury is not a bank, and your Brex Cash account is not a bank account.

Investing in securities products involves risk. Use of the Brex API is subject to the Brex Access Agreement.īrex Treasury LLC is an affiliated SEC-registered broker-dealer and member of FINRA and SIPC that provides Brex Cash, an account that allows customers to sweep uninvested cash balances into certain money market mutual funds or FDIC-insured bank accounts at Brex’s partner banks, such as JPMorgan Chase Bank, Member FDIC and LendingClub Bank, N.A., Member FDIC. See the Brex Platform Agreement for details. provides the Brex Mastercard® Corporate Credit Card, which is issued by Emigrant Bank, Member FDIC or Fifth Third Bank, NA., Member FDIC. Terms and conditions apply and are subject to change.īrex Inc. “Brex” and the Brex logo are registered trademarks.īrex products may not be available to all customers.

0 kommentar(er)

0 kommentar(er)